st louis county sales tax rate 2019

Statewide salesuse tax rates for the period beginning January 2019. If you need access to a database of all Missouri local sales tax rates visit the sales tax data page.

A county-wide sales tax rate of 2263 is.

. And the 05 Public Safety Sales Tax. The Minnesota state sales tax rate is currently. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

The St Louis County sales tax rate is. 2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St Louis 66673 KB Historical Property Tax Rates for City of St Louis 66536 KB. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

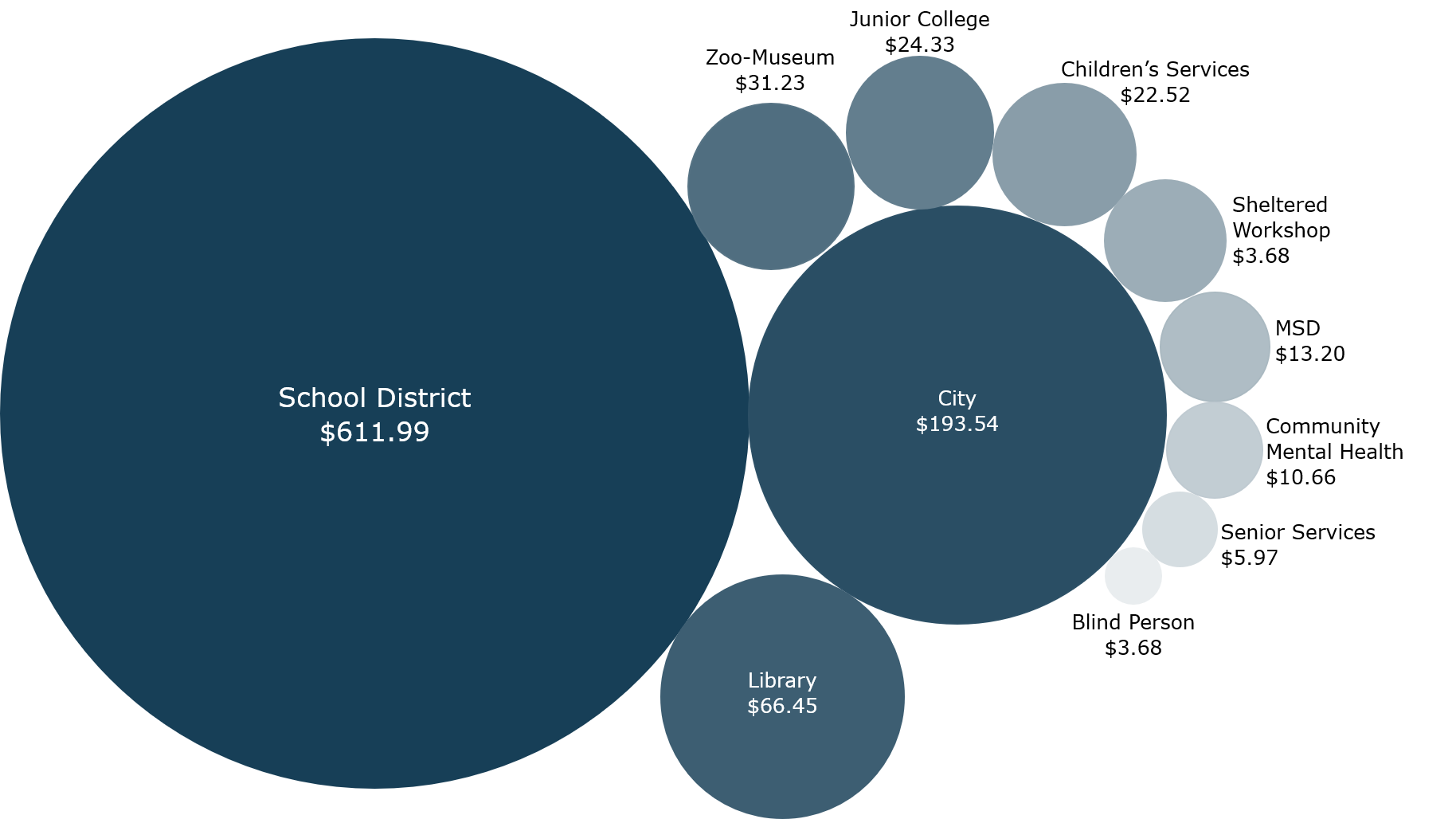

In 2019 the tax rate was set at 816 and distributed as follows. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. Wentzville MO Sales Tax Rate.

Subtract these values if any from the sale. Revenue Information Bulletin 18-017. Louis County an overview of the Countys progress and financial performance that is transparent and easily understood.

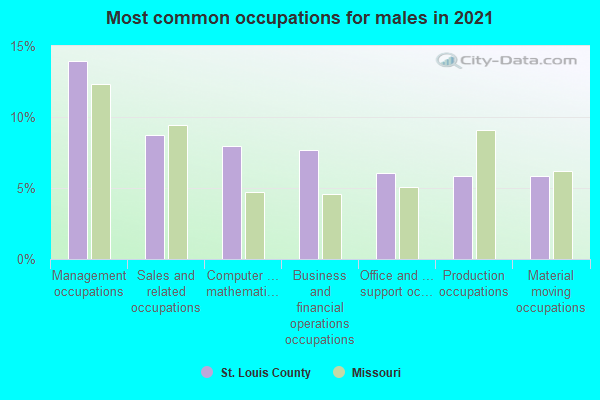

Louis County is also an important employment center with approximately half of the metropolitan areas jobs and one quarter of all jobs in. Lv meaning in texting. The minimum combined 2022 sales tax rate for St Louis County Minnesota is.

Statewide salesuse tax rates for the period beginning October 2019. Louis County is the 43rd largest county in the United States. 01 Metro Parks Sales Tax.

Springfield MO Sales Tax Rate. Louis County provides the annual Financial Transparency Report for the fiscal year ending December 31 2019. Louis County residents It is with great pleasurethat St.

The 01875 Arch-River Sales Tax. With a population of 994205 St. No The manufacturing exemption use tax rate is 000.

There is no applicable county tax. I am optimistic that these estimates are conservative as current 2018 revenues are 64 higher than they were last year. Sales tax revenues are projected to increase by 63 million or 16 in 2019.

The Missouri state sales tax rate is currently. Saint Louis MO Sales Tax Rate. October November December 2019 Updated 9102019 Taxation Division Sales and Use Tax Rate Tables Missouri Department of Revenue Run Date.

The 2018 United States Supreme Court decision in South Dakota v. Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. Louis County is the largest county in Missouri containing 16 percent of the states population.

Table of Sales Tax Rates for Exemption for the period July 2013 June 30. It is my desire to deliver the residents of St. 9102019 TA0300 Display Only Changes.

Saint Joseph MO Sales Tax Rate. Raytown MO Sales Tax Rate. Revenue Information Bulletin 18-019.

This is the total of state and county sales tax rates. Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. 082019 - 092019 - XLS.

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. The Public Safety Sales Tax which began collections in the fall. You pay tax on the sale price of the unit less any trade-in or rebate.

Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. Only Seattle would have higher base sales tax rate of major US. Saint Peters MO Sales Tax Rate.

Louis which may refer to a local government division. The sales tax jurisdiction name is St. The St Louis County sales tax rate is.

Missouri has 1090 cities counties and special districts that collect a local sales tax in addition to the Missouri state sales taxClick any locality for a full breakdown of local property taxes or visit our Missouri sales tax calculator to lookup local rates by zip code. ALL FUNDS REVENUES IN MILLIONS 2017 Actual 2018 Budget Estimate 2018 Revised Estimate Change Change 2019 Projected Change Change Tax Revenue Property Tax 1089 1143 1197 109 100 1132 65 54 Sales Tax 3426 3795 3910 483 141 3973 63 16. 012019 - 032019 - PDF.

Louis county real property search. Saint Charles MO Sales Tax Rate. Clark County Tax Rates for 20192020 Posted by Las Vegas Homes By Leslie - on Tuesday August 13th 2019 at 138pm.

Has impacted many state nexus laws and sales tax collection requirements. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The chart below indicates the 111 tax districts in Clark County and the individual clark county washington sales tax rate 2019 tax rates.

This is the total of state and county sales tax rates. University City MO Sales Tax Rate. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax.

The 2018 United States Supreme Court decision in South Dakota v. Louis Sales Tax is collected by the merchant on all qualifying sales made within St. Wildwood MO Sales Tax Rate.

102019 - 122019 - XLS. Statewide salesuse tax rates for the period beginning April 2019. These revenues are projected to be 1132 million in 2019 an increase of 18 million or I 6.

44 rows The St Louis County Sales Tax is 2263.

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

States With Highest And Lowest Sales Tax Rates

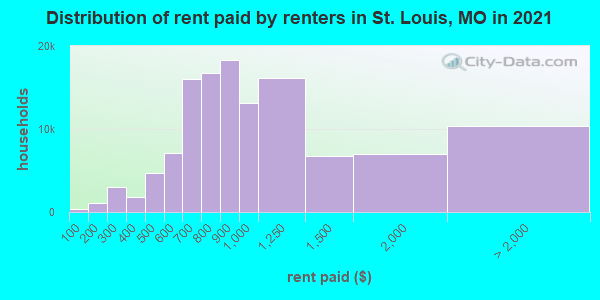

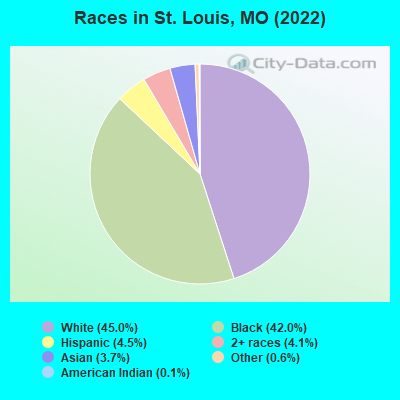

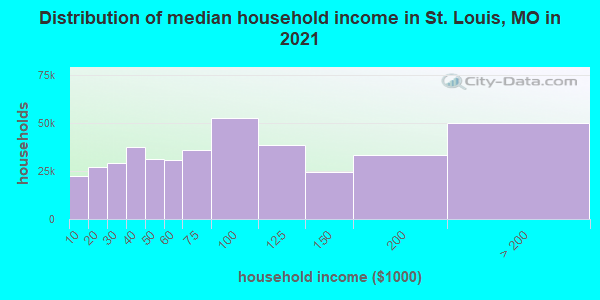

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

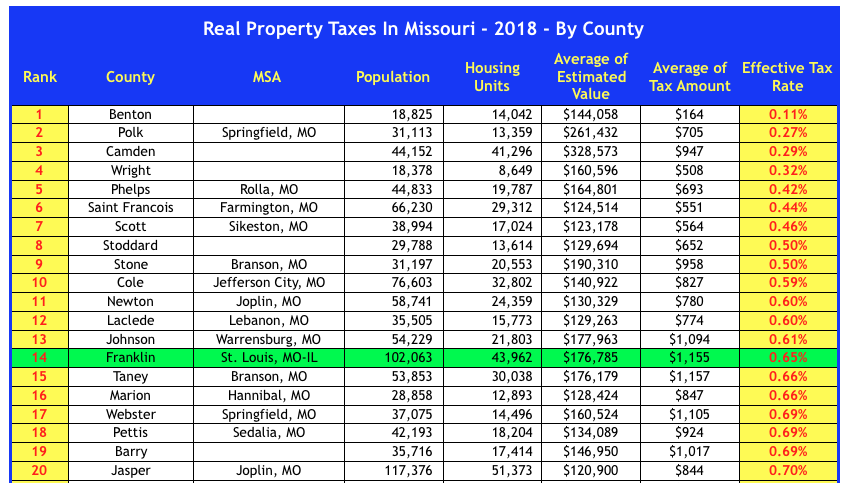

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Real Property Tax Sale St Louis County Website

Collector Of Revenue St Louis County Website

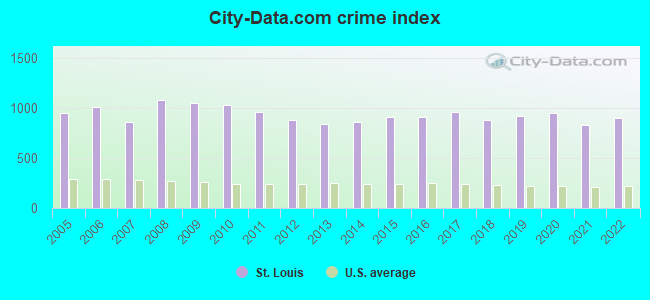

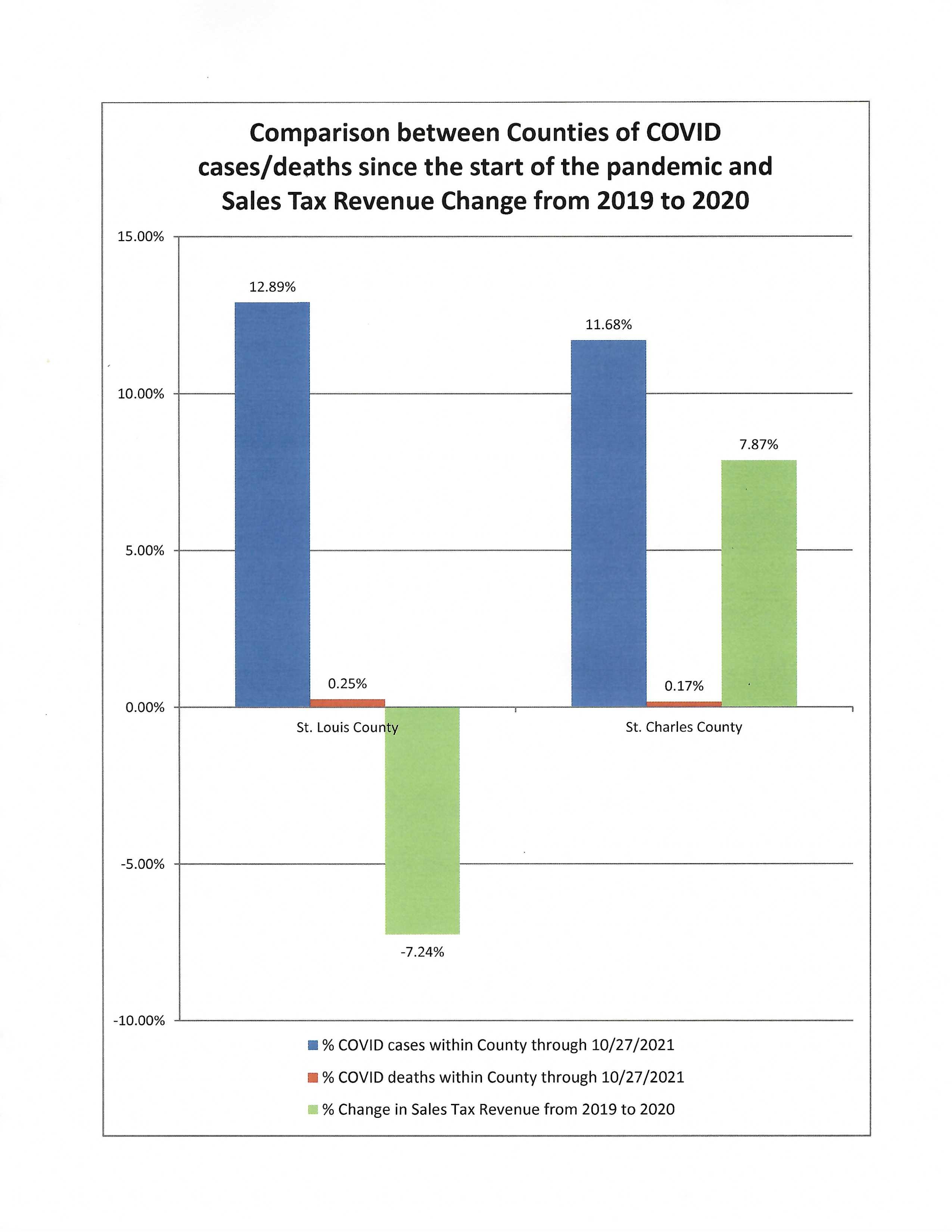

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Tim Fitch Chieftimfitch Twitter

Chesterfield Missouri S Sales Tax Rate Is 8 738

Sales Tax On Grocery Items Taxjar

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Taxable Sales Down In Many St Louis Areas Show Me Institute

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed